XRP Price Prediction: Analyzing Investment Potential Amid Technical Consolidation and Bullish Fundamentals

#XRP

- Strong Institutional Adoption: XRP ETFs nearing $1 billion milestone demonstrate growing institutional confidence and capital inflow.

- Technical Consolidation with Upside Potential: Current price consolidation above key support levels suggests preparation for next upward move toward $2.30 resistance.

- Expanding Ecosystem Utility: New DeFi protocols and record network activity indicate growing real-world utility beyond speculative trading.

XRP Price Prediction

XRP Technical Analysis: Consolidation Phase with Bullish Potential

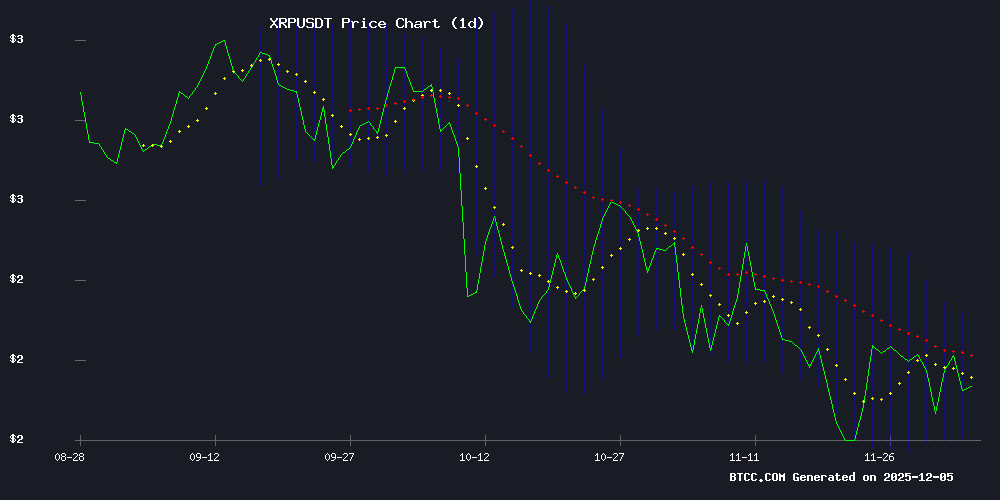

XRP is currently trading at $2.0813, slightly below its 20-day moving average of $2.1301, indicating a period of consolidation. The MACD indicator shows a bearish crossover with a value of -0.0142, suggesting some short-term selling pressure. However, the Bollinger Bands reveal that the price remains well above the lower band of $1.9517, with the middle band at $2.1301 and upper band at $2.3085 providing clear resistance and support levels.

According to BTCC financial analyst Sophia, 'The technical picture shows XRP in a healthy consolidation phase after recent gains. The price holding above the lower Bollinger Band suggests underlying strength, while the proximity to the middle band indicates potential for a breakout toward the $2.30 resistance level if buying pressure returns.'

XRP Market Sentiment: Strong Fundamentals Drive Optimism

Market sentiment for XRP appears overwhelmingly positive based on recent developments. The cryptocurrency has surged 12% amid increased network activity and institutional demand, with XRP ETFs approaching the $1 billion milestone led by Bitwise. Record-high XRP velocity indicates significant whale activity and ETF demand, while new developments like Firelight's XRP DeFi insurance protocol on Flare Network add to the ecosystem's growth.

BTCC financial analyst Sophia notes, 'The convergence of institutional adoption through ETFs, increasing whale activity, and expanding DeFi infrastructure creates a powerful bullish narrative for XRP. The $2.28–$2.75 price target zone mentioned in recent predictions appears achievable given these fundamental drivers.'

Factors Influencing XRP's Price

XRP Price Prediction: Whale Inflows Signal Potential Breakout Toward $2.28–$2.75 Zone

XRP holds steady above a rising channel support level at $1.95–$2.00 as whale activity surges. The cryptocurrency, which rallied 430% from November 2024's $0.50 base, now faces resistance near $2.62–$2.80. Market structure suggests accumulation, with historical patterns indicating such consolidation often precedes significant moves.

Regulatory clarity and Ripple's RLUSD stablecoin launch provide fundamental support, while compressed volatility keeps traders alert for breakout signals. Analysts caution that despite bullish technicals, broader crypto market uncertainty warrants measured positioning. The $2.28–$2.75 zone emerges as the next key test for XRP's momentum.

XRP Price Surges 12% Amid Network Activity and Institutional Demand

XRP has rallied 12% since November 21, reclaiming critical support levels above $2.15. The surge reflects heightened network activity and institutional interest, with the XRP Ledger velocity nearing a yearly high of 0.0324—a signal of robust liquidity and whale participation.

Exchange balances tell a compelling story: 930 million XRP tokens have exited exchanges over the past month, underscoring holder conviction. This supply squeeze coincides with spot order sizes sustaining elevated levels for 30 consecutive days, reinforcing bullish momentum.

The ledger’s current activity rivals its most frenetic periods in 2025, suggesting sustained engagement. Traders are watching whether this marks the beginning of a prolonged recovery phase for the embattled asset.

XRP ETFs Near $1B Milestone as Bitwise Leads Surge

The XRP ETF market is approaching a watershed moment, with total assets nearing $1 billion just two weeks after launch. Bitwise emerges as the dominant player, recording $5.07 million in volume—outpacing competitors Franklin Templeton ($4.43M), Canary Capital ($2.82M), REX-Osprey ($1.85M), and Grayscale ($1.32M).

Market momentum builds with the quiet persistence of a rising tide. Since November's inaugural fund launch, institutional inflows have maintained relentless consistency, transforming XRP into the ecosystem's unwilling protagonist. Today's $19 million total trading activity marks another inflection point in this organic growth story.

XRP Velocity Hits Record High Amid Surging Whale Activity and ETF Demand

XRP's on-chain velocity has reached unprecedented levels, signaling heightened activity among whales and traders. The token's network activity reflects renewed interest from large holders, with velocity peaking at 0.032—a figure not seen in months.

ETF inflows have compounded the momentum, with $205 million flowing into XRP-related products over the past week. Grayscale's 2GXRP ETF alone attracted $39 million in a single day, pushing total ETF assets beyond $906 million.

Analysts emphasize the $2 price level as a critical threshold for XRP to challenge the $2.50 resistance. The ledger's accelerated capital turnover suggests traders are rapidly adjusting strategies to capitalize on market shifts.

Firelight Launches XRP DeFi Insurance Protocol on Flare Network

Firelight Finance has introduced a staking protocol for XRP on the Flare network, marking a strategic move to bring institutional-grade security and yield opportunities to the XRP ecosystem. The protocol, which went live on December 3, enables users to stake XRP and receive stXRP—a liquid token designed to earn rewards through a decentralized insurance model.

Leveraging Flare Network’s infrastructure, the system aims to address two critical gaps in DeFi: protection against rising hacks and yield generation for XRP holders, an asset historically sidelined in decentralized finance. Audits have already been completed, with the bridge operating under distributed governance.

stXRP functions as a liquid staking token (LST), allowing participants to maintain liquidity while their underlying XRP remains locked. This innovation opens doors for deeper integration with other DeFi protocols, expanding utility for long-term XRP investors.

XRP Bullish Momentum Builds: ETF Inflows Push Price Toward $2.75

XRP's bullish momentum continues as institutional interest fuels a potential breakout. The cryptocurrency trades at $2.17 with a $131.41 billion market cap, bolstered by $5.10 billion in 24-hour trading volume. ETF inflows have remained positive for 11 consecutive days, pushing assets under management to $844 million.

Bitwise, Canary Capital, and Grayscale have driven growth in XRP-centered ETFs, signaling institutional confidence. Despite broader market volatility, XRP-based ETFs attracted $89 million in inflows on December 1st, underscoring robust demand.

A decisive break above the $2.28 resistance level could propel XRP toward $2.75. Market dominance stands at 4.15%, reflecting its moderate influence amid short-term fluctuations.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment opportunity with measured risk. The cryptocurrency shows strong institutional adoption through nearing $1B in ETF assets, significant whale accumulation signaling confidence, and expanding utility with new DeFi protocols.

Technically, XRP is consolidating in a healthy range between $1.95 and $2.30, with the current price of $2.08 positioned for potential upward movement. The 12% recent surge demonstrates strong momentum, while the Bollinger Bands suggest room for growth toward the $2.30 resistance level.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $2.0813 | Trading below 20-day MA, consolidation phase |

| 20-Day Moving Average | $2.1301 | Immediate resistance level |

| Bollinger Upper Band | $2.3085 | Near-term price target |

| Bollinger Lower Band | $1.9517 | Strong support level |

| Recent Price Change | +12% | Strong bullish momentum |

| ETF Assets Approaching | $1 Billion | Significant institutional adoption |

As BTCC financial analyst Sophia emphasizes, 'The combination of technical consolidation near support levels and overwhelmingly positive fundamentals creates an attractive risk-reward profile. Investors should monitor the $2.30 resistance level for confirmation of the next leg upward toward the $2.28–$2.75 target zone.'